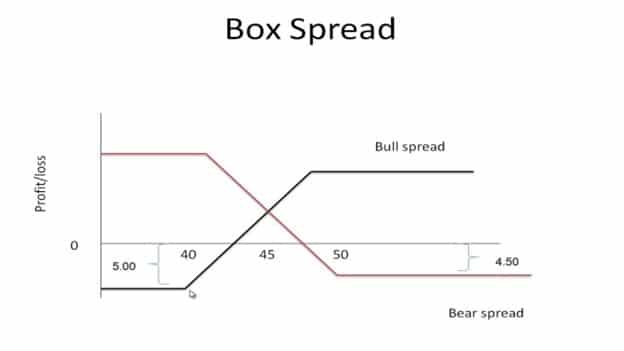

Among more advanced options trading strategies, box spreads stand out for their ability to potentially lock in virtually risk-free arbitrage profits under the right conditions. Also known as long box or combo spreads, this four-legged strategy combines bull call spreads with bear put spreads on the same asset to capitalize on declining volatility.

A box spread is a sophisticated options trading strategy primarily used by experienced traders to lock in risk-free profits or manage portfolio risk. This strategy involves constructing a “box” by simultaneously entering into two vertical spreads: a bull call spread and a bear put spread with the same strike prices and expiration dates. The goal is to capitalize on price discrepancies or to leverage the strategy for near-zero risk arbitrage.

Box spreads are often employed in stable or low-volatility markets where traders seek guaranteed returns equivalent to the difference between the strike prices minus the cost of setting up the spread. The profitability arises when the combined premiums paid and received align with the intrinsic value of the spreads.

A unique aspect of box spreads is their close connection to the concept of interest rates. Since the payoff is predetermined, traders use box spreads to mimic risk-free bonds or as a way to lock in returns when interest rates influence the pricing of options.

While the strategy is effective for arbitrage or securing low-risk returns, it requires a deep understanding of options pricing, substantial capital for execution, and keen attention to transaction costs and tax implications. Mastering box spreads can be a powerful tool in a trader’s arsenal.

Properly constructed, box spreads offer traders the opportunity to realize profits from options mispricing with minimal risk. However, box spreads require substantial capital and defined upside. In this comprehensive guide, we’ll break down everything you need to know about box spread strategies including how they work, risks and rewards (it’s not necessarily the same as in 777 bet casino), requirements, and when they may make sense to deploy.

What Are Box Spread Options Strategies?

A box spread involves simultaneously buying and selling an equal number of bull call spreads and bear put spreads on the same underlying asset with the same expiration. Here is how it works:

- Buy 1 in-the-money call with lower strike price

- Sell 1 out-of-the-money call with higher strike price

- Sell 1 in-the-money put with lower strike price

- Buy 1 out-of-the-money put with higher strike price

By combining these 4 legs in a box – 2 calls and 2 puts – the strategy aims to lock in profits as implied volatility decreases. The box spread legs hedge each other, making the trade capital intensive but largely risk-defined.

How Do Box Spreads Work?

Box spreads are constructed using carefully selected options strike prices so that the trade can be entered for a net credit (or at least for zero debit). This results in locked-in potential profit with high probability.

The maximum potential gain is capped at the difference between the strike prices of the calls and puts. This profit is realized at expiration if volatility declines as expected. If volatility increases, the maximum loss is usually limited to the initial debit (or premium) paid.

Let’s walk through a basic example:

- Stock XYZ is trading for $50

- Buy 1 in-the-money $45 call for $6

- Sell 1 out-of-the-money $55 call for $1

- Sell 1 in-the-money $45 put for $6

- Buy 1 out-of-the-money $35 put for $1

The trade nets a $2 credit. Maximum profit is $10 if XYZ closes between $45 and $55 at expiration when volatility drops. Maximum loss is just the initial $2 debit.

Benefits and Applications of Box Spreads

Used properly, box spreads offer traders several advantages:

- Low Risk Arbitrage – When constructed as an arbitrage, box spreads have very limited risk and locked-in upside.

- Take Advantage of Volatility Skews – Profit from volatility skews across different options on the same underlying.

- Volatility Trading – Profit from IV declining without forecasting market direction.

- High Leverage – The high leverage amplifies profits but also maximizes capital required.

Box spreads shine when used to capitalize on volatility skews and price distortions between related options. But traders must watch for transaction costs eroding the thin profits of the trade.

Risks and Drawbacks of Box Spread Strategies

While box spreads have defined risks, they do come with drawbacks:

- Strict Profit Caps – Upside is strictly limited by construction at the difference between strike prices.

- Substantial Capital Required – Each leg must be fully funded, requiring large outlays.

- Difficult Construction – Precise strike selection needed to achieve proper hedge and credit entry.

- Strict Greeks – Greeks like delta and theta must remain close to flat to minimize directional risks.

- Transaction Costs – Bid-ask spreads on 4 legs add friction that diminishes thin profits.

- Early Assignment Risk – Assignment risk grows as expiration nears, especially for in-the-money legs.

Aside from strict profit caps, the large capital requirements to fund each option leg are the biggest hindrance and downside to employing box spreads.

Key Tips for Implementing Box Spreads

Here are important tips to mitigate risks when executing box spreads:

- Construct spreads for a net credit to lower breakeven

- Choose equidistant strike prices to optimize Greeks

- Monitor for early exercise as expiration approaches

- Use European-style options to avoid early assignment

- Manage transaction costs to maximize thin profits

- Watch for price distortions across related options

- Maintain disciplined trade sizing given strict risk/reward

Careful construction, monitoring, and sizing discipline are critical to successfully trading box spreads.

Conclusion

Box spreads offer a way for sophisticated options traders to potentially lock in low-risk arbitrage profits around IV contractions. However, their strict requirements, capital intensity, and transaction costs make proper execution critical. Box spreads reward those traders with the knowledge to identify mispriced options spreads and the account size to fund their substantial requirements. When deployed strategically under the right conditions, box spreads demonstrate the power and flexibility of options as an instrument. But prudent risk management and construction remain essential to their success.

Buy Me A Coffee

The Havok Journal seeks to serve as a voice of the Veteran and First Responder communities through a focus on current affairs and articles of interest to the public in general, and the veteran community in particular. We strive to offer timely, current, and informative content, with the occasional piece focused on entertainment. We are continually expanding and striving to improve the readers’ experience.

© 2026 The Havok Journal

The Havok Journal welcomes re-posting of our original content as long as it is done in compliance with our Terms of Use.